Indicators on Unicorn Financial Services You Should Know

Wiki Article

Fascination About Mortgage Brokers Melbourne

Table of Contents7 Simple Techniques For Loan Broker MelbourneMelbourne Broker for DummiesExamine This Report about Mortgage Brokers MelbourneExamine This Report about Melbourne Broker6 Simple Techniques For Refinance Broker Melbourne

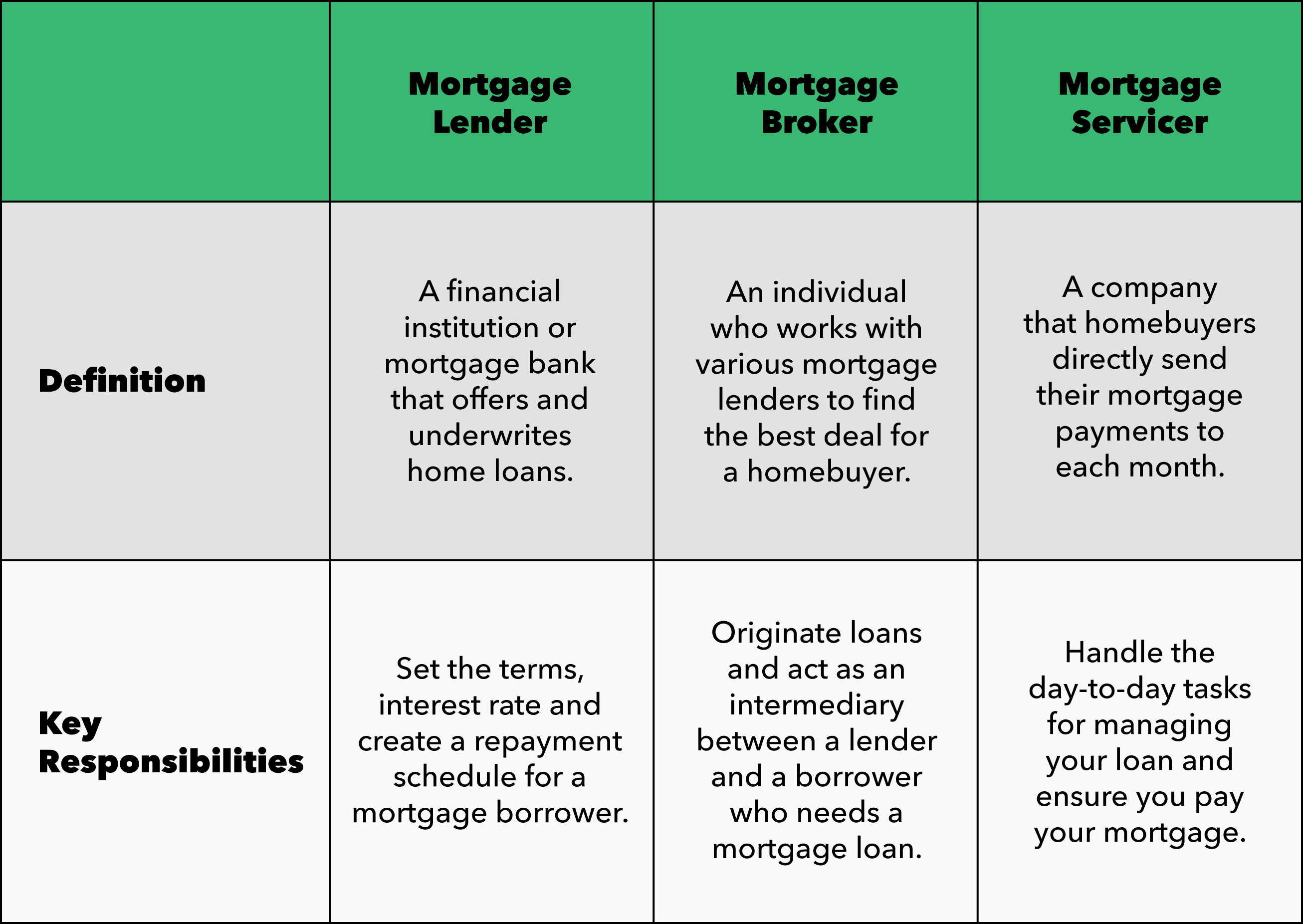

An expert home mortgage broker comes from, discusses, and processes household and industrial home loan in behalf of the customer. Below is a six point overview to the services you must be used and also the expectations you must have of a certified home loan broker: A mortgage broker supplies a variety of home loan from a variety of various lending institutions.A home mortgage broker represents your passions instead than the passions of a borrowing organization. They need to act not only as your agent, however as an experienced expert and also problem solver. With access to a variety of home loan items, a broker is able to supply you the best value in regards to rates of interest, payment amounts, and financing items (mortgage brokers melbourne).

Lots of situations require greater than the easy use of a thirty years, 15 year, or adjustable price home loan (ARM), so ingenious home mortgage approaches and also advanced options are the advantage of working with an experienced mortgage broker (https://namethatcitation.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A mortgage broker navigates the client through any type of situation, taking care of the process as well as smoothing any kind of bumps in the road along the road.

Customers who discover they need bigger loans than their bank will certainly approve additionally take advantage of a broker's understanding and capacity to successfully get funding. With a home mortgage broker, you just need one application, instead than finishing types for each and every specific loan provider. Your home mortgage broker can offer a formal comparison of any type of finances advised, directing you to the info that properly represents price distinctions, with current prices, points, and closing expenses for each and every funding mirrored.

The smart Trick of Refinance Melbourne That Nobody is Discussing

A trustworthy mortgage broker will divulge exactly how they are spent for their solutions, along with information the complete expenses for the finance. Customized solution is the distinguishing factor when selecting a home mortgage broker. You need to expect your home mortgage broker to assist smooth the method, be offered to you, and recommend you throughout the closing procedure.

Dealing with a home mortgage broker can potentially conserve you time, effort, and cash. A mortgage broker may have better as well as a lot more access to lending institutions than you have. A broker's rate of interests might not be straightened with your own. You may obtain a much better offer on a finance by dealing directly with lenders.

All about Mortgage Broker In Melbourne

A mortgage broker performs as go-between for an economic establishment that offers car loans that are secured with realty and individuals who wish to buy actual estate and also need a finance to do so. click to investigate The home mortgage broker collaborates with both consumer and also lender to get the customer approved for the finance.A home loan broker normally deals with several lenders and also can supply a variety of funding alternatives to the consumer (https://essentialbizlistings.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A borrower doesn't need to deal with a mortgage broker. They can work straight with a lending institution if they so pick. A loan provider is a banks (or individual) that can supply the funds for the genuine estate purchase.

A lender can be a financial institution, a credit rating union, or other financial business. Possible residence buyers can go straight to any kind of lender for a funding. While a mortgage broker isn't essential to promote the purchase, some lending institutions may only overcome home loan brokers. If the loan provider you prefer is amongst those, you'll need to use a mortgage broker.

They're the person that you'll take care of if you approach a lender for a loan. The finance police officer can help a debtor recognize and select from the fundings provided by the lending institution. They'll address all inquiries, assist a customer obtain pre-qualified for a financing, and help with the application procedure.

Some Of Mortgage Broker Melbourne

Home mortgage brokers do not supply the funds for car loans or authorize funding applications. They aid people looking for house car loans to discover a lender that can money their residence acquisition. Start by ensuring you recognize what a home mortgage broker does. Then, ask good friends, family members, and also organization acquaintances for recommendations. Have a look at online evaluations as well as look for problems.Inquire about their experience, the accurate assistance that they'll give, the fees they charge, and how they're paid (by loan provider or debtor). Likewise ask whether they can assist you specifically, given your specific financial situations.

Encountered with the issue of whether or not to use a home loan broker or a loan provider from a bank? When you are looking to get a residence, nevertheless, there are 4 crucial aspects that home loan brokers can offer you that the loan providers at the financial institution just can not.

Individual touch appears to be increasingly less typical in today's culture, however it shouldn't be. None people live the same life as an additional, so personalization is vital! Getting a residence is type of a large bargain! At Eagle Home loan Business, individual touch is something we pride ourselves in. You reach collaborate with among our representatives personally, who has years of experience and can answer any type of concerns you may have.

The Buzz on Melbourne Mortgage Brokers

Their hrs of operation are typically while you're already at work. Obtain the personal touch you should have with a home mortgage broker that cares! The adaptability a home mortgage broker can supply you is simply one more reason to prevent going to the financial institution.

Report this wiki page